Canada is the largest foreign provider of oil and gas to the United States, and the two countries are generally friendly, making many Americans not even consider Canada a foreign energy source, or deem it an acceptable one. Still, many Canadian citizens, oil and gas equities, and the country itself, must not be feeling too pleased by the recent U.S. government's denial of the Keystone pipeline, which would have facilitated the distribution of dramatically increased levels of Canadian petroleum into the Unites States.

Additionally, natural gas prices within North America have fallen dramatically over the last two years, reaching historical lows within 2012. The apparent bottoming process for natural gas process may be over, as gas prices have increased by about 30 percent over the last month, but such is no certainty. Moreover, the capacity and trade problems highlighted by the Keystone roadblock have compelled many investors to exit positions in Canadian petroleum equities, and especially those with high exposure to natural gas.

Further, the Canadian dollar is primarily backed by the nation's natural resources, and has come under weakness versus the U.S. dollar over the last several quarters, after most commodities peaked and started to decline, including oil and gold. Recent European instability has further bolstered the U.S. dollar versus most commodities and the currencies that rely upon them.

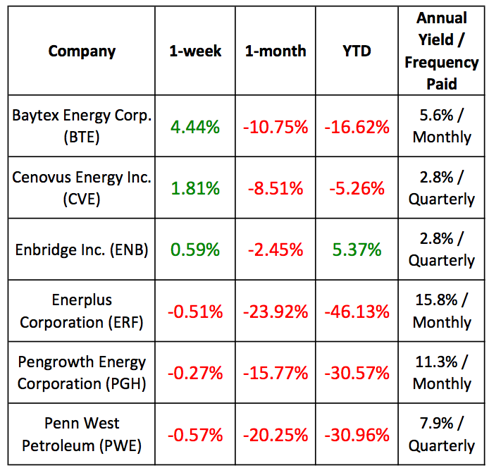

Below is a recent performance table for six high yield Canadian oil & gas equities that trade within the United States (listed in alphabetical order): Baytex Energy Corp. (BTE), Cenovus Energy Inc. (CVE), Enbridge Inc. (ENB), Enerplus Corporation (ERF), Pengrowth Energy Corporation (PGH) and Penn West Petroleum Ltd. (PWE). I have included their one-week, one-month and 2012-to-date equity performance rates, as well as their current yields.

Click to enlarge

For years now, natural gas prices have trended lower, as new technology has increased natural gas supplies far faster than demand for it has grown. Most Canadian oil and gas equities followed oil and gas price fluctuations, and haven't changed their dividend policies in several quarters. The recent low gas prices have caused some investors to question the sustainability of several of these lofty dividends, especially if oil follows gas lower.

In the last month, the above-listed equities averaged a decline of 13.61 percent, and the group now averages a decline of 20.7 percent since the start of the 2012. The declines were accelerating in early May, but the group appears to have stabilized over the last week or two.

Last week, the group actually averaged a 0.92 percent appreciation, with half of the equities appreciating and the other half all declining by less than 1 percent. This could indicate we are at a bottom for these equities, provided the commodities that they produce, oil and gas, can maintain their present price ranges.

Many may argue that dividend cuts have been priced into several of these equities, though others would assert that they should fall further upon such an announcement. Several have maintained their current dividend policy for the last two years, with half of the above-listed companies reporting and paying their dividend on a monthly basis. The higher dividend payers have certainly been the worst performers out of the group within 2012. Below is a three-month share performance comparison chart for the six above-mentioned Canadian petroleum producers:

Over time, it is expected that a growing amount of both oil and gas might find its way to western Canada for export to China, but such transfers take time, and pipeline build-outs are expensive and slow. It is possible that Canada could supply both China and the U.S., but issues of scale and capacity will have to be resolved.

Though outside the control of these companies, an additional Canadian pipeline to the U.S. could easily become a key issue of political debate during the second half of this election year. It is possible that the previously denied Keystone pipeline or another potion of it will get approved within the next two quarters, to prevent its absence from becoming a sore point for political targeting, and any such approval would broadly bode well for Canadian energy companies

Disclosure: I am long PGH.

joe paterno memorial service taco bell breakfast menu ener1 national chocolate cake day epstein joshua komisarjevsky barney frank

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.